Foreign nationals who seek permanent residency in the United States have found the EB-5 visa program to be a popular option. The immigration services program provides a way forward for those eligible to obtain a green card and invest in the economy. One way the investors can participate in this program is via an EB-5 regional center.

The Regional Center Program, also known as the Immigrant Investor Pilot Program, was established by Congress in 1992 and is in charge of setting aside EB-5 visas for investing participants to work towards gaining United States citizenship.

The foreign investment benefit for immigrant investors of a regional center is the allowance to partake in an investment opportunity that is convenient and has a higher chance of permanent residency within the U.S.

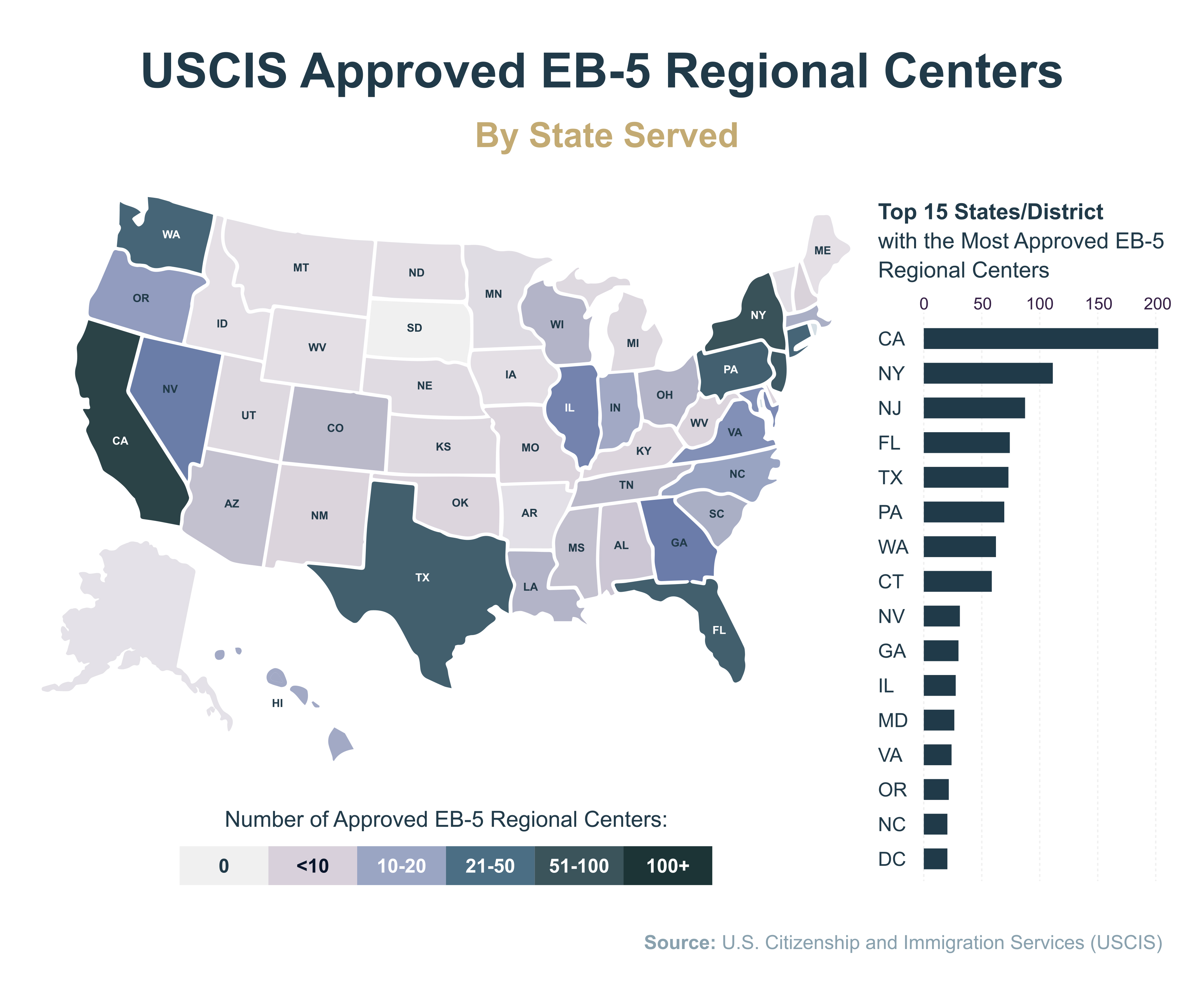

The United States Citizenship and Immigration Services can approve regional center applicants who file an I-956 application submitted by an entity to qualify as a regional center. As of April 2023, there were 640 existing regional centers nationwide.

Making eligible investments in EB-5 projects sponsored by regional centers can qualify foreign investors for the EB-5 program, assuming these regional center projects create a minimum of ten new United States jobs per investor.

What Are EB-5 Regional Centers?

An EB-5 Regional Center is any public or business economic unit that promotes the growth of the economy. These EB-5 regional centers were established under the EB-5 immigrant investor program guidelines.

An EB-5 Regional Center organization works as a job-creating entity with the purpose of stimulating the economic growth of the United States through job creation and foreign investment. Therefore, the Regional Center is eligible to accept immigrant investor funding.

Regional Centers are designated by the United States Citizenship and Immigration Services (USCIS), which are managed by Homeland Security. USCIS-approved regional centers act as a middleman between the investors and EB-5 projects. Any business organization that is seeking regional center designation is required to submit a sample private placement memorandum (PPM) to the USCIS.

The Securities and Exchange Commission (SEC) regulates all EB-5 projects because it is a public offering given to prospective investors. Once an investor obtains a conditional green card, to avoid losing their permanent residency status, they must maintain USCIS compliance by updating all the documents requested and abiding by the resident requirements. In addition, there is a $10,000 annual fee for EB-5 regional centers with under 20 investors and a fee of $20,000 for more than 20 investors.

Source: https://iiusa.org/blog/a-deep-dive-into-the-data-lake-of-eb-5-regional-centers-statistics/

Advantages of Becoming a Regional Center

Being designated as an EB-5-approved Regional Center by the USCIS has many advantages for your business. The primary benefit of investing through a regional center is the proven track record of direct job creation. The USCIS gives approved regional centers the ability to count job requirements from the indirect, direct, and induced jobs created with the regional center project; however, when investing in a New Commercial Enterprise (NCE), a business project can count only direct jobs.

When you have a Regional Center designation, you can create business projects that raise low-interest debt. The EB-5 Immigrant Investor Program raises capital uniquely when compared to funding using traditional sources. The EB-5 Regional Center program became popular when traditional lending started to become tougher to come by due to the Credit Crunch in 2009; it continues to have a significant advantage in an exciting and ever-changing industry.

Regional Center Investment Benefits

There are several benefits to investing in Regional Centers over direct investments, making it a great option for investors. Some of the main benefits of EB-5 Regional Center investing are:

Creating Jobs

A primary reason for investing in an EB-5 regional center is the possibility of job creation. The USCIS has pre-approved regional centers for job creation in a specified geographic area. These can be indirect jobs or direct jobs, and both types can be counted by investors for the required ten jobs per investment.

Because this is required for EB-5 investors to gain their green cards, Regional Center investments can help make immigration more likely to be a success. Most EB-5 investments are made to Regional Centers located in targeted employment areas (TEA), which are typically rural areas or locations with high unemployment. Between 2008 and 2015, the total foreign direct investment was $20.6 billion generated by the EB-5 program.

Reduction of Risk

Compared to direct investments, there is a reduced risk of investing in Regional Centers. Several regional centers have had repeated records of success and typically have a portfolio diversified with regional center projects. There are management teams with experience mitigating risk and ensuring that investments are structured properly. There are typical reporting requirements for regional centers, which can help investors keep better oversight and greater transparency.

Passive Investment

Regional Center investing is a passive investment, which means there is no requirement for management in day-to-day activities from the investors. The Regional Center creates a Limited Liability Company, and the investor typically becomes a limited partner. When the regional center forms the Limited Liability Company (LLC), every investor will invest in the LLC, becoming a limited partner, where the regional center would act as the general partner.

This is a significant benefit for investors who want to obtain a permanent green card in the U.S. while maintaining their business interests, desire the ability to travel throughout the United States, keep up with their current lifestyle, or cannot participate in business activities. Passive investment allows investors to get a better handle on their investment strategy by investing in a Regional Center that aligns with their risk tolerance and personal goals.

Direct investment projects could require EB-5 investors to step in and actively take on a management role.

Investment Process Made Easier

Compared to a direct investment, the investment process into Regional Centers can be much easier. There is often an investors team that works with Regional Centers to help give investment advice to investors throughout the process, from the first investment to the point of permanent residency. By having this added assistance, investors can avoid making costly mistakes and are better able to navigate the intricate requirements of the EB-5 program. Oftentimes there have been relationships already established between the USCIS and Regional Centers, which can assist in speeding up the application process.

Diverse Portfolio of Projects

When you invest in a Regional Center, you gain access to regional center projects that contain a diverse portfolio. There are a variety of industries that regional centers will invest in, including hospitality, infrastructure, and real estate. This can expose immigrant investors to multiple industries while also mitigating risks. Regional Centers can increase the probability of successful investment funds by investing in projects with higher return potential.

Potential for Higher Returns

There is a possibility for higher returns when you invest in a Regional Center rather than a direct investment. Since regional centers can gather funds that come from several EB-5 investors, they can work with EB-5 projects that have returns with a higher potential. Regional centers often have lender relationships that can help secure beneficial financing terms and increased returns.

What Is The Difference Between an EB-5 Direct and a Regional Center?

One way to gain an EB-5 visa is through the Regional Center program, but another way is through direct investment. Many investors find the EB-5 process to be easier with the Regional Center model. Here we will look at the difference between the direct investment and the Regional Center investment models.

Direct Investment Model

Under the direct investment model, there is usually one investor assigned to a project, and the investor must be involved in either an advisory or managerial capacity. This would require the investor to be involved in EB-5 business plan decision-making. Therefore, an immigrant investor must stay actively involved when making a direct investment.

Regional Center Investment Model

There are multiple investors that purchase equity stakes from an investment fund using the regional center investment model. That fund is then used to purchase capital from the loans of the job-creating entity (the loan model) or equity in the entity creating the jobs (the equity model).